Horizon Omnia reduces competition, provider access, and raises healthcare costs; here’s how.

The headline read “Confidential documents suggest Horizon misled public on how it picked hospitals for OMNIA program”. Was Horizon interested in saving costs by developing Omnia, or picking winners and losers in the hospital systems, as well as in other parts of their network to increase our costs and their profits?

In 2015, Horizon announced Omnia that offered the promise of revolutionizing health care options in the state.

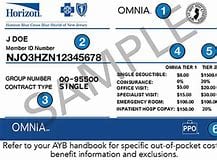

Horizon Omnia was to offer lower premiums in exchange for a network that was based on cost and value using a two tiered plan that offered incentives via lower copayments in tier 1 and higher costs if you used tier 2 providers who are also in their network. They wanted the public to believe that tier 2 providers and hospitals were more expensive. What tier 2 actually did is make it more expensive for the public to visit tier 2 providers, while reducing the copayments and upfront costs to tier 1 provider, regardless of the amount these providers actually charged. The effect was Horizon was picking winners and losers economically, by making certain doctors and hospitals cost more to their patients while offering lower co-payments and deductibles to those who were chosen to be in Tier 1.

Horizon systematically priced people out of their single-tier Advantage plans during open enrollment on the NJ exchange and then discounted Omnia to make it look much less expensive. They also sold the Horizon Omnia network to school systems and other health care buyers with the idea that it would reduce costs while increasing access, with reduced upfront costs for patients if they used their Tier 1 providers, while Tier 2 providers would cost the patient more per visit and may have a high deductible as a disincentive to use those providers. In some plans, the disincentive was a $2500 deductible and 50% coverage thereafter if the provider was in tier 2, while the tier 1 providers had a relatively affordable copayment per visit.

Buyers of Horizon Omnia found out that many of their cost-effective providers and hospitals after purchasing the plan were designated as tier 2 under Horizon Omnia. This meant that their trusted provider would cost them more with a higher copayment or deductible, while if they picked a new Tier 1 provider, their costs would be less. Those who were required to purchase their insurance on the exchanges because they were able to get a government premium supplement, would never find out that Horizon still offered their non-tiered Advantage plans for just slightly more per month because Horizon Advantage was only being offered through insurance agents and could no longer be found on the exchange. Was this bait and switch or did the public as Horizon suggests overwhelmingly gravitate to this plan because they wanted a more confusing healthcare marketplace with caveats?

Chiropractors, viewed as part of the solution to the opioid crisis have only 6% of their member base listed as tier 1, with the balance being tier 2. Few chiropractors have affiliation with hospitals at this time, and as a result, could not join a hospital and improve their standing in Horizon as Tier 1 providers. This has left many chiropractic patients choosing more expensive services that were less effective for common problems such as neck and back pain while enduring more tests such as MRI’s when a few chiropractic visits may have resolved their problem. Was this discrimination or were they trying to reduce access to affordable care options that the public wants to increase premiums and improve their profits?

If Omnia was about affordability, cost, and accessibility as they advertise in their press releases, why was Horizon economically forcing patients to choose care that was more expensive, more time consuming, and less effective?

Many doctors affiliated with tier 2 hospitals found themselves losing business because their patients now had deductibles as high as 2500 dollars before any benefits were paid on plans patients purchased on the exchanges, while the tier 1 hospitals did not have these types of cost barriers. Many tier 2 hospitals that were well regarded, well-rated, and trusted parts of their communities were forced to lay off employees and downsize because of Horizon’s activities with Omnia.

Many doctors affiliated with tier 2 hospitals found themselves losing business because their patients now had deductibles as high as 2500 dollars before any benefits were paid on plans patients purchased on the exchanges, while the tier 1 hospitals did not have these types of cost barriers. Many tier 2 hospitals that were well regarded, well-rated, and trusted parts of their communities were forced to lay off employees and downsize because of Horizon’s activities with Omnia.

The facts on how Omnia became public may lead to lawsuits because of the restraint of trade.

We are beginning to understand that Horizon developed their relationships with the two largest healthcare monopolies in the state before actually studying the marketplace for the Omnia product. Horizon had actually predetermined that they wanted Barnabus and Hackensack hospital networks to be partners in the Omnia program. In New Brunswick, St. Peters hospital is affected by the Omnia network since they are tier 2 and they are now suing Horizon. It is clear that having health care monopolies was good for Horizon since they could now justify increasing their healthcare premiums year after year, which improves Horizon’s profits, which are based on a percentage of premiums. Unfortunately for us, there is a point where their actions and the actions of other insurers may spin out of control and we will have runaway healthcare costs. Perhaps, we are already past that point.

Some hospitals paid large fees to join these already large networks so they two can be in the lower-priced tier. As a result, the large hospital networks continued to grow, and the formerly tier 2 hospitals now became tier 1, meaning they would get more business and so would their doctors. This consolidation of the marketplace reduces the ability for insurers to negotiate prices.

In 2016, Horizon Omnia premiums claimed they were saving us money, when in fact, the more comprehensive Omnia plan Gold had a 24% increase from the year before. True, their lower bronze and silver HSA plans increased only about 5 percent, however, these types of products have the consumer paying large amounts of medical bills before Horizon Omnia pays anything because of their high deductibles.

Was this sleight of hand actually a good deal for us, the consumer? Are monopolies good for the consumer? Have you ever taken an airplane flight lately and seen the level of service improve with industry consolidation or are you paying more and getting less?

Perhaps it times for the department of insurance to consider banning tiered plans that pick winners and losers based on the whims of an insurer whose motivation is higher costs and profits, by creating a flawed tiered health plan that reduces access and competition through their economic clout, since they control the majority of the NJ marketplace for health insurance. Is the Barnabus – Robert Wood Johnson merger resulting in a healthcare conglomerate that is too big to negotiate with for lower healthcare costs. How about the Meridian system?

If Horizon wants to help solve the opioid crisis using Omnia, why did they put one of the least expensive provider groups, chiropractors as tier 2 and use the tiers to make chiropractors and other quality providers and hospitals look appear to be more expensive? These groups are actually more affordable and perhaps, more effective groups of healthcare providers that the public wants to visit.

Maybe it is time to break up the too big to fail healthcare monopolies created by Omnia before it is impossible to rein in healthcare costs in NJ. Should you buy an Omnia plan, or perhaps, maybe using a private insurance agent may find you a better value Advantage plan that is still offered for just a few dollars more, without the bait and switch of tiering? Shouldn’t health insurance be straight forward and just cover your care, without all of this interference. Maybe it is time for the department of insurance to investigate this before it’s too late.